U.S. expat taxes are a bit more complex than regular taxes. There's a couple of additional forms that help you either exclude or minimize your earnings on your US taxes. So, in order to be able to use things like the foreign income exclusion or the foreign tax credit or the foreign housing credit, which we will speak about, you have to pass one of two tests. 2. The first test is called the physical presence test. This basically is a tax break for people that are working outside of the US. The way this one works is you have to be outside the US inside a foreign country for 330 days in any 12-month period. Some people come to us and say things like, "Oh, you know, I'm moving abroad in June. How do I get this set up?" Well, you would just start on the day you go abroad in June and then it ends 12 months later. And you just have to be out of the country or inside a foreign country for 330 out of 365 days. 3. Now that's the way you've been doing it for the last couple of years, right? Exactly, yeah. So when I found out about that, you know, I said, well, this is great. So, I've actually designed my schedule around that. So, I usually go home for right up to 35 days every year. So, I do one continuous month basically every year. And I've gotten fairly close a few times in terms of I'm always worried about flight delays and that kind of thing if you, you know, and then that big nor'easter in December that forces a layover for an extra day or so. Yeah, sort of that's my sort of way of making up for being away for...

Award-winning PDF software

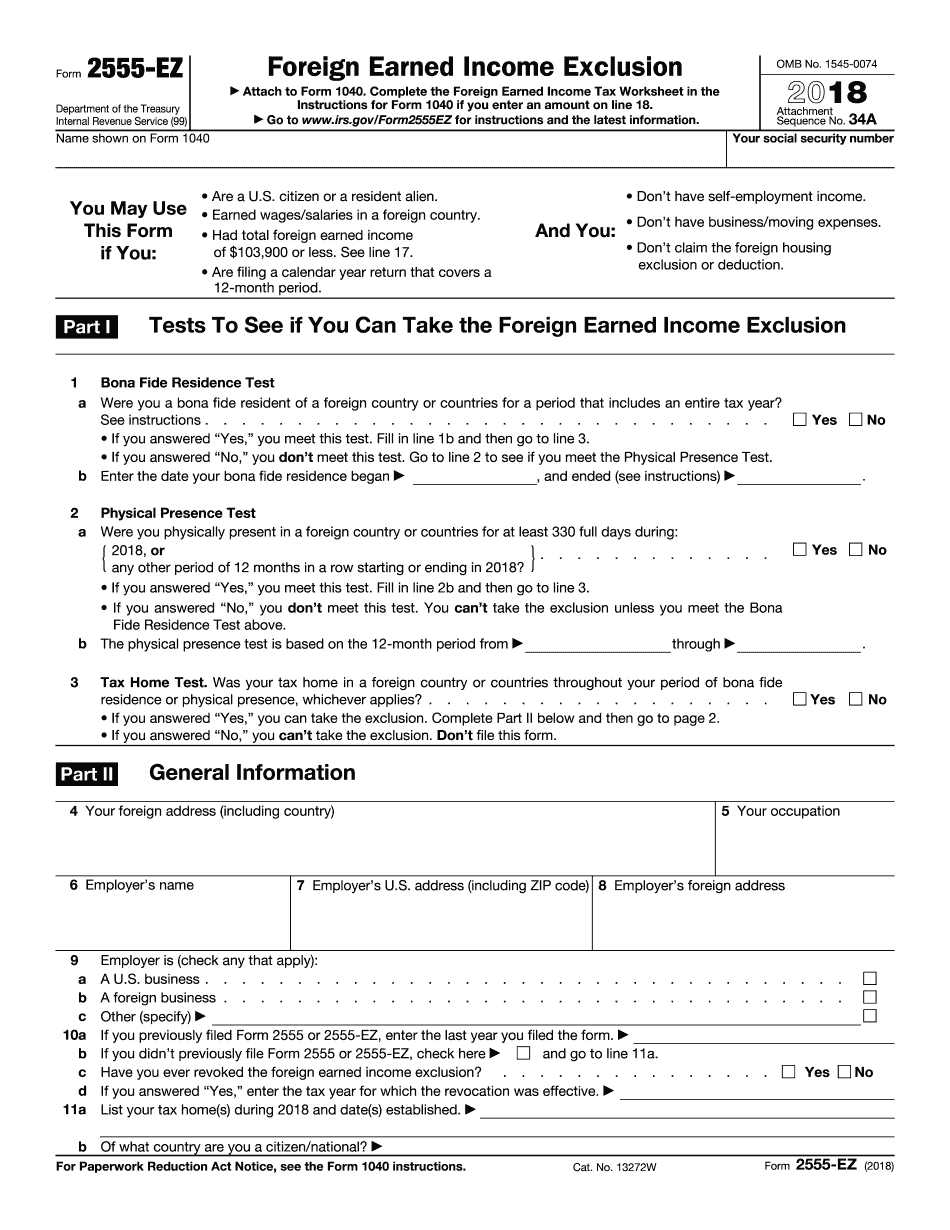

2555-EZ Form: What You Should Know

For a detailed and up-to-date explanation about the IRS's procedures for Collection Due Process hearings, see: What Is a Collection Due Process Hearing? — Solo The purpose of the collection process is to recover delinquent taxes or penalties, and to compensate the Internal Revenue Service for the costs of collection. The Internal Revenue Service (IRS) has several types of collections proceedings in addition to those described above. The following are described as: IRS Form 8300 and Internal Revenue Manual (IRM) 76-2950, Collection Due Process; IRM 76-2950, Application for an Order for Collection; IRM 76-2960, Collection Due Process Hearing; IRM 76-2965, Settlement and Refund Proceedings; IRM 76-2970, Notice of Collection Final Decision The IRS uses these collection processes as a means to pursue delinquent tax debt, recover the unpaid tax debt, and compensate the IRS for the costs of collection. What Is a Collection Due Process Hearing The purpose of a collection proceeding is to establish whether the return or payment is timely filed or that the tax was properly assessed. If no timely filed return or payment is established, the return or payment is deemed an overpayment and the taxpayer is issued a notice of deficiency. If the notice is not appealed, the taxpayer is treated as if he or she is being assessed any unpaid tax due. When the IRS collects taxes through a collection proceeding, collection tax assessments are made by the Office of Undersecretary for Enforcement (OWE). Each determination of a collection is based upon the facts and circumstances under which the taxpayer or his or her agent acted. The assessment of tax, interest, and penalties is made by an independent federal tax assessment court (IRMA) for certain types of cases when the Department of the Treasury (Treasury) determines that any collection, including interest, under IRC §6021 is warranted by the evidence. The determination by the IRS of whether to appeal each determination of a collection, or whether to collect a tax under IRC §6021 is made by the Office of Undersecretary for Enforcement (OWE). To determine whether a particular determination or decision makes the taxpayer liable for an overpayment or collection tax, the determination should be reviewed and, if appropriate, appealed. The determination can also be appealed based upon other factors, such as the application of law or the extent to which other collection procedures are followed.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 2555-EZ, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 2555-EZ online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 2555-EZ by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 2555-EZ from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 2555-EZ