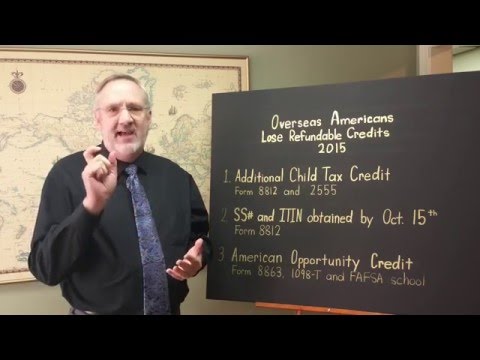

Hi, I'm Brett Willoughby, CPA. Today, we want to talk about the 2015 tax law changes that affect overseas Americans. Let me give you a little background first. Congress has a problem. Overseas Americans have a problem. Congress has a problem because they're giving away more money; they're spending more than they're taking in, and they want to give away more tax benefits. So, they have to increase revenue somewhere. Their second problem is that historically, 25% of all refundable credits are fraudulent. Refundable credits are things like the Earned Income Credit and the additional child tax credit. Basically, you can get a refund from the federal government even if you didn't pay anything in and have no income tax liability. Unfortunately, these refundable credits have become targets for people who want to fraudulently file tax returns to receive cash back. Overseas Americans also have a problem because they don't have good representation in Congress. There's no natural constituency for them. All the overseas Americans are scattered, and they're not concentrated in one state. Congress prefers to make laws that benefit their constituents, and without a strong representation, overseas Americans are left behind. The US has a worldwide tax system, which means that overseas Americans are taxed on all their earnings. The recent changes in tax laws start pulling back some of the tax benefits for overseas Americans. Let's start with the American Opportunity Credit. This credit also acts as a refundable credit and allows you to receive up to a thousand dollars per child who is attending college as cash in your pocket. Any college that is eligible for FAFSA (The U.S. financial aid package) can qualify for this credit. This includes most colleges in America and even some colleges outside America. However, the problem arises when it comes to obtaining...

Award-winning PDF software

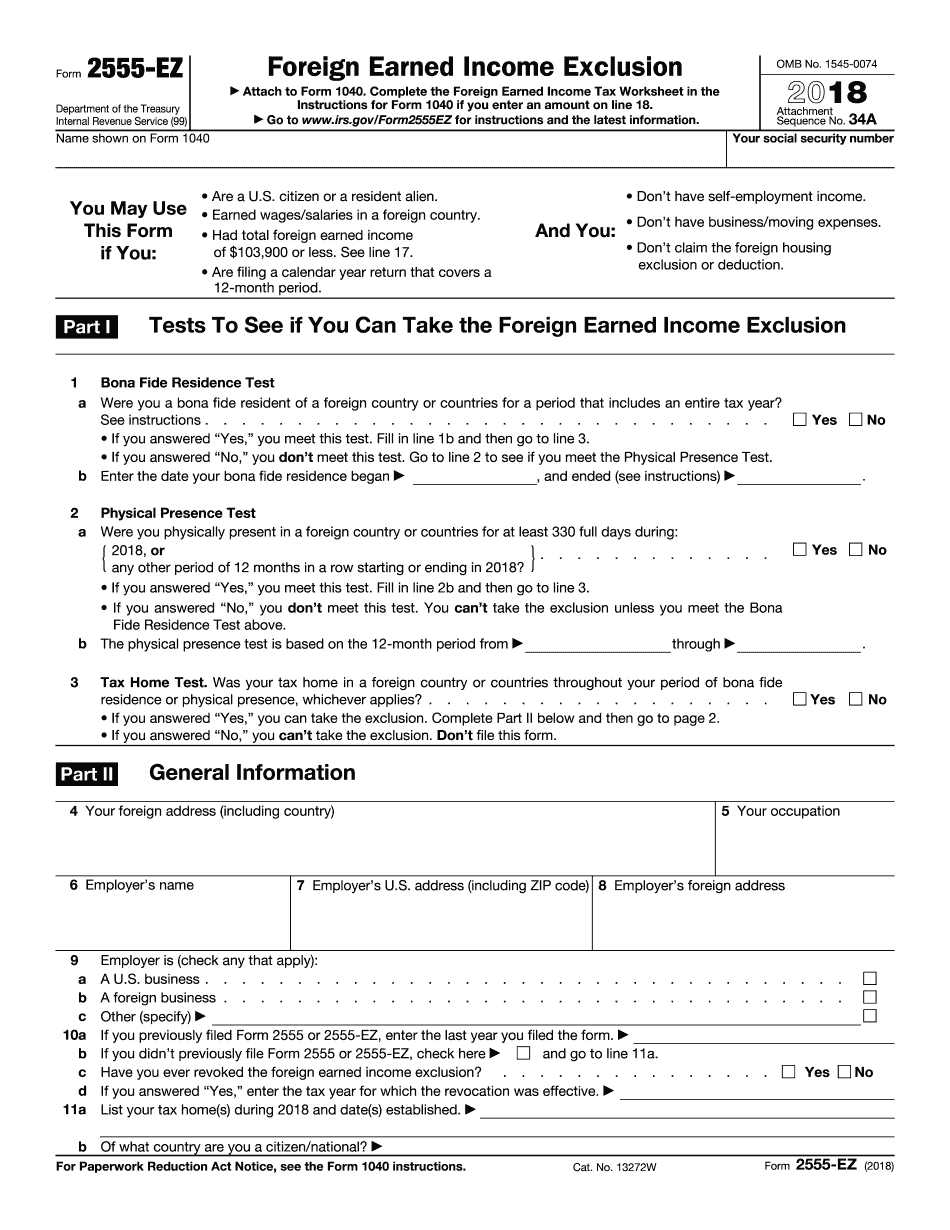

2555 Ez example Form: What You Should Know

Form 2555: Foreign Earned Income Exclusion | IRS Sep 30, 2025 — The FEE does not allow you to exclude any taxable income earned by you or your dependents. You can still exclude up to the entire amount of foreign earned income included in your Foreign Earned Income Exclusion: Understanding Form 2555 Jul 1, 2025 — Including up to 105,900 in foreign earned income in your 2025 U.S. expat taxes does not apply until 2023. The FEE begins to apply, and the foreign earned income exclusion ceases to be available, in 2018. Foreign Earned Income Exclusion: Understanding Form 2555 Sep 30, 2025 — You can exclude up to 107,600 of foreign earned income from your 2025 taxes if you meet the seven conditions listed at (see below). Mar 15, 2025 — If you are a foreign dependent, the exclusion starts to phase out in 2019. Foreign Tax Credits | FAFSA Oct 5, 2025 — If you want to exclude amounts paid by your employer from your US expat taxes, include your full tax year federal income tax return with your form. Here is how. Sep 23, 2025 — Use Form 2555-EZ, which you can use to claim your foreign earned income exclusion for the year. You may use a different format if you are filing separately from a spouse. If you are filing jointly from a spouse, Form 2555 allows you to exclude the portion of the foreign earned income you claimed on Line 2 of Schedule M-1 (Form 1040) for the years you lived with them for the entire year, even if you only lived with them briefly for the entire year. Form 2555, Form 2555-EZ, Form 2555-K (Foreign Earned Income Exclusion), Forms 2555A and 2555B Sep 30, 2025 — Use Form 2555-EZ, Form 2555-K, or Form 2555A/B, as appropriate, to claim the foreign earned income exclusion. 2018 Instructions for Form 2555-EZ — IRS Oct 7, 2025 — You can start the exclusion phaseout for the tax year by filing your US expat returns for the tax year.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 2555-EZ, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 2555-EZ online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 2555-EZ by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 2555-EZ from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 2555 Ez example