Hello, my name is Benjamin Heart, an American attorney, and the managing director is Harry Legal here in Bangkok, Thailand. This video is, as the title suggests, about taxes for Americans living abroad. Many people mistakenly believe that they are not required to file tax returns to the United States because they live abroad. However, this is a common misconception. Unlike citizens of many countries, US citizens are required to pay taxes on their worldwide income. There are exclusions and codes for those who live abroad. One notable exclusion is the foreign earned income exclusion, which allows American citizens who earn foreign income while living abroad to exclude a certain amount from their taxable income each year. If you make under a certain amount of money, you may be exempt from certain taxes. However, if your income exceeds the threshold, there will be a recalculation. Although one is required to file taxes while living overseas, it does not necessarily mean they have to pay anything. Most individuals will fall under the foreign earned income exclusion, which is currently set at a little over $100,000. In my experience, most people living and working in Thailand do not earn that much in personal income. It should be noted that even though taxes need to be filed, they may not necessarily need to be paid. One needs to file their taxes to potentially qualify for the foreign earned income exclusion. It's a good idea to get this stuff filed, as the exemption doesn't kick in unless you file your taxes. Furthermore, once you file your taxes, you essentially cooperate with the notion of a statute of limitations. It's essential to keep in mind that filing taxes does not automatically mean you have to pay anything to the IRS.

Award-winning PDF software

2555 Ez instructions 2025 Form: What You Should Know

You may have received one of these forms automatically if you filed Form 1099-S. If you had already filed a 1099-DIV electronically, you will receive a new 1099-DIV by mail by February 28, 2020; however, you should keep the original, and not save it for filing, since this new 1099-DIV may be amended at any time. It is helpful to have your paper Form 1099-DIV ready to file with Form 1099-INT when asked by an agent. The purpose of Form 1099-DIV is to help you report certain taxes that you pay on your interest, dividends or other capital gains or income. (Dividend and interest are not taxable, as these income categories are only for certain specified purposes.) If you have income from all sources, you are required by law to complete an income tax return every tax year. You may be able to complete a Form 1040EZ (with no due date stamp). Alternatively, you may be able to use the 1040A and 1040EZ (no due date stamp). For a complete discussion about how to fill out your tax return, please see: Tax Filing Instructions. If you are filing a separate return for each of your accounts, you will only have to file one form. If you do not know whether you have to file a separate return, you are not required to file a separate return; however, you may want to fill out the form anyway. The IRS has provided the following list of what you need to include on each of your forms. Dividends: Include any dividend, interest, or capital gain you earned or received from any source. You have to report any and all dividends that you are required to report. Dividends from municipal bonds—including any municipal bond that will mature on or after October 1, 2018, will be included. Interest on money market funds, certificates of deposit, or money market mutual funds—will be reported on Form 1099-INT. Gain or loss from an independent investment advisor—will be reported on Form 1099-DIV. Dividends received or gains realized when property is sold—will be reported on Form 1099-DIV. This may be a taxable event for some people; however, it may not be considered income for others. Dividends received from an accredited college, university, etc., are reported on Form 1099-DIV.

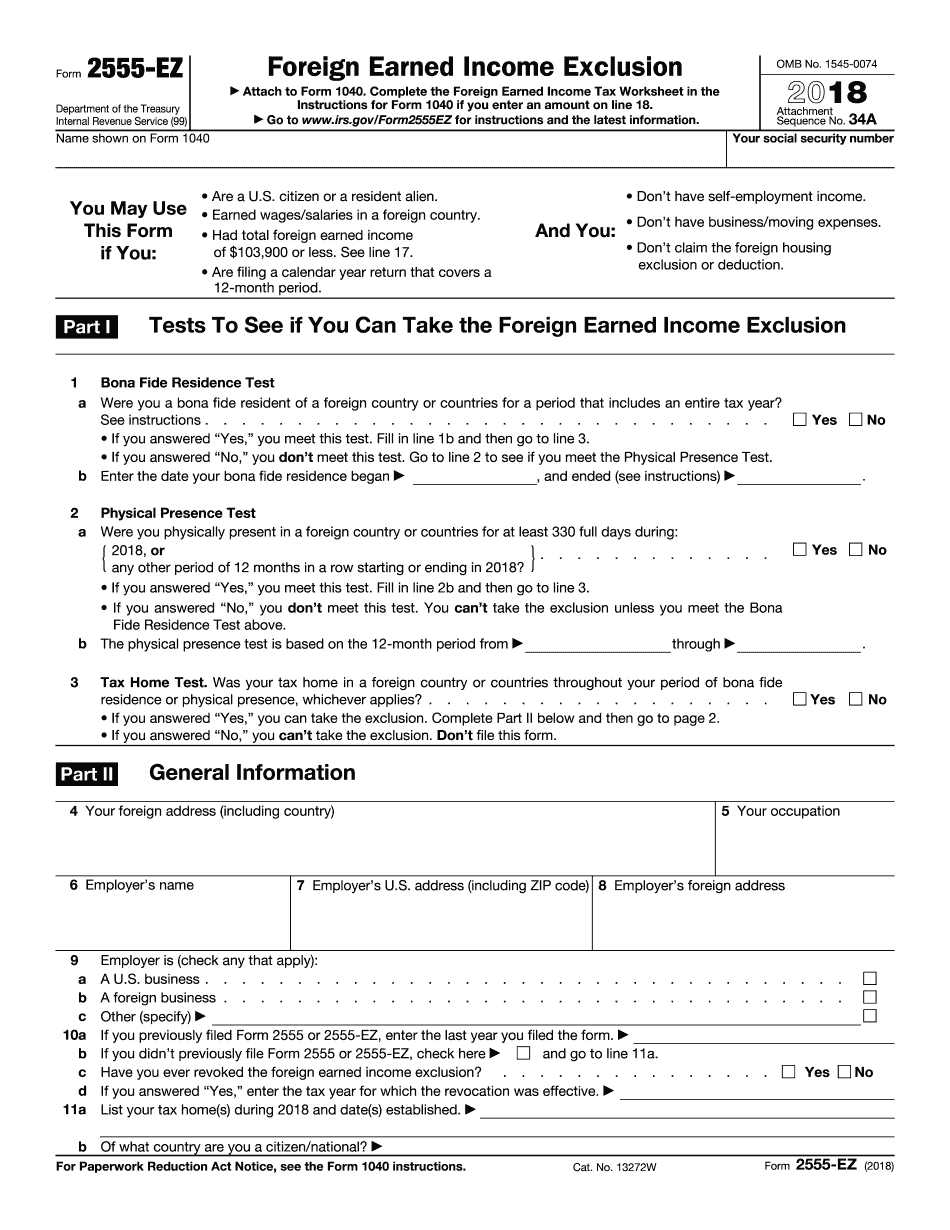

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 2555-EZ, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 2555-EZ online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 2555-EZ by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 2555-EZ from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 2555 Ez instructions 2025