Award-winning PDF software

1116 Form: What You Should Know

IRS Form 8937 You must complete IRS Form 8937 to claim a foreign tax credit on your tax return. See here. IRS Form 941 You can report or remit all taxes you owe and avoid an interest penalty on Form 1040 and Schedule A. You can also apply for a tax deduction on your federal tax return and still claim the tax credit on Form 1116. IRS Form 946, Exemptions and Credits This form doesn't have all the same requirements, but it doesn't have the same limitations. IRS Form 948 (Form 948) See IRS instructions for Form 948. IRS Form 948 (Form 948) — How to Claim the Foreign Tax Credit Form 948 is very similar to Form 1116. However, you can claim the credit for any taxes you paid to any country other than the U.S. if: You meet the other requirements listed in IRS instructions. Form 948 also reduces your total federal Income Tax for that year. However, you are allowed to only claim up to 2,500 for the credit. IRS Form 961, Exemption From Foreign Income Taxes; Income Tax Treaty With Respect to Non-US A foreign country or territory is a foreign country or territory that is not a treaty or other international agreement, and that is not a dependent area of the United States, where U.S. tax laws apply. Other than Puerto Rico and American Samoa, this is the only exception. U.S. persons who are U.S. citizens, eligible to vote, resident aliens or any other type of foreign persons are NOT eligible to claim the tax credit under 1131. IRS Form 945 and Form 964 — Reporting Tax to Taxpayers Overseas There are many options for reporting tax at the same time as it is being paid to taxes that you owe in the United States. IRS Form 886, Foreign Bank and Financial Accounts This will show what type of bank accounts and other property are in the account and how much the account has. IRS Form 709 — Bank Transfer of Foreign Property to the United States This will show the bank and asset records for the property. IRS Form 710, Transfer of Foreign Real Property to the United States This will have details on the purchase of the property and the sales proceeds.

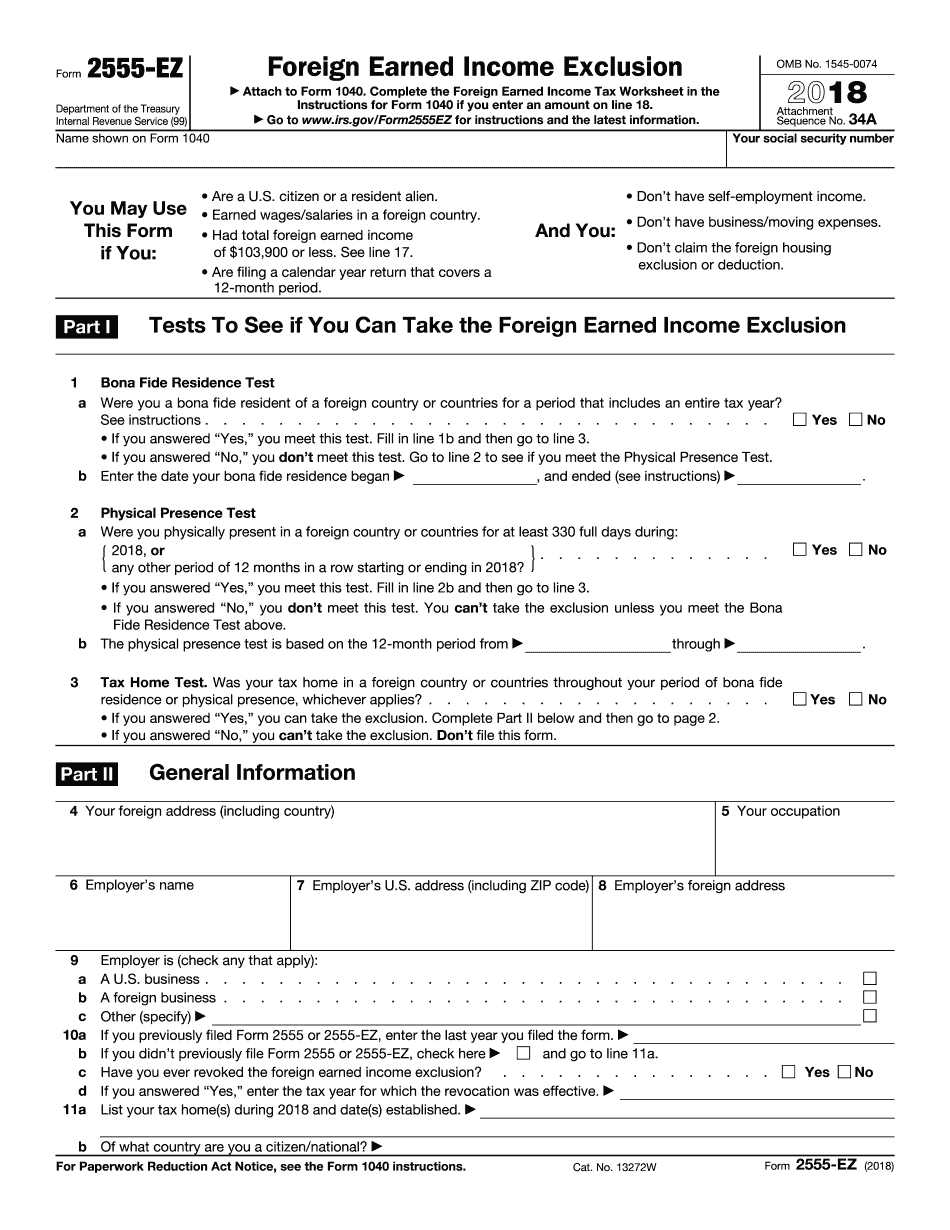

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 2555-EZ, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 2555-EZ online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 2555-EZ by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 2555-EZ from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.