Award-winning PDF software

Form 2555-EZ for Eugene Oregon: What You Should Know

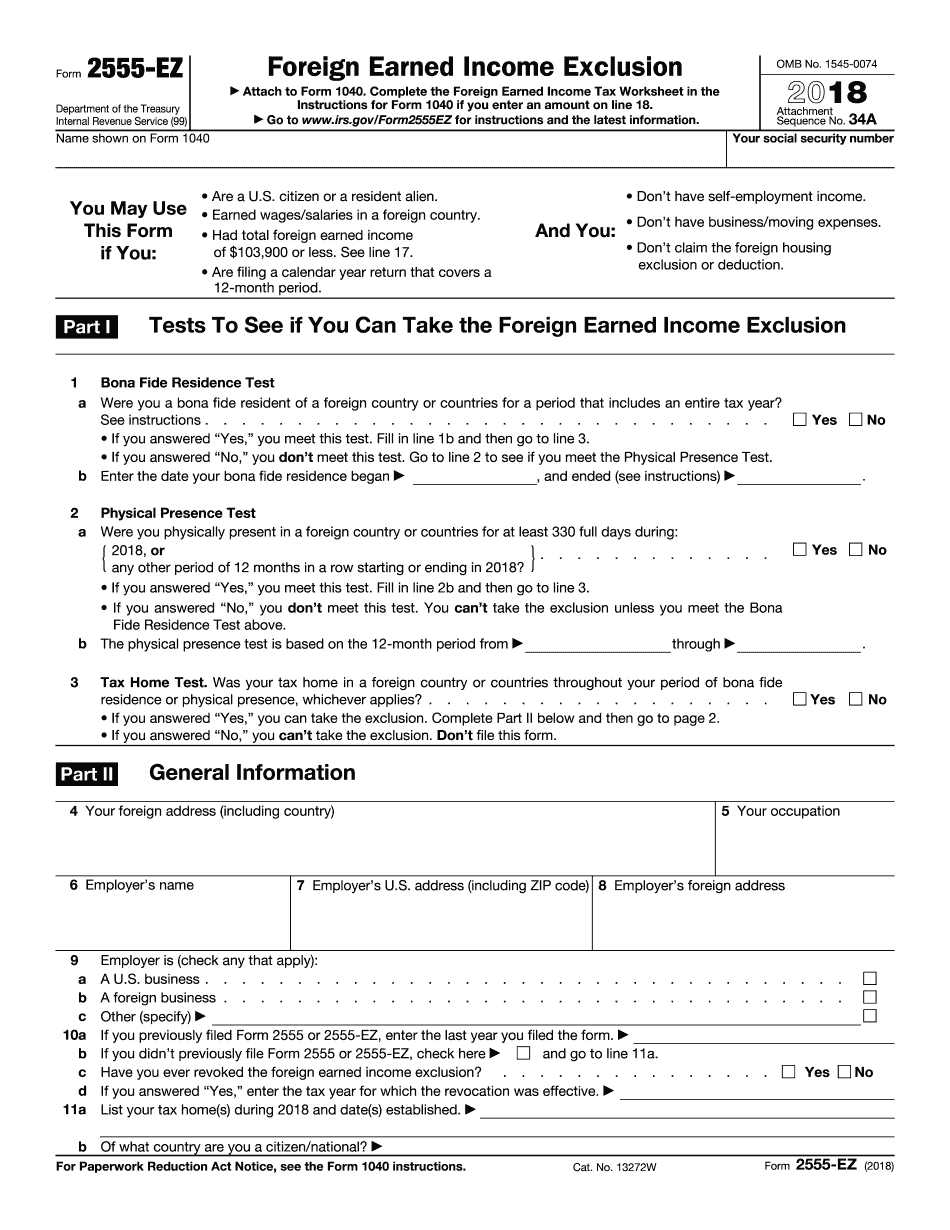

Enter information only when it's needed to calculate the exclusion. Use only your own income and expenditures for your property, goods, furniture, and services for 21 days after each tax period (including any extension). Line 23 — Include all earned income, regardless of whether you work for yourself from home. If you do, fill out line 21. Also include noncash wages and other noncash expenses for the property you own or possess, including business investments and income from rental properties. Also include any property you've donated to qualified charity after January 1, 2020. See Excluded Income, later, for details about certain kinds of Excluded Income, later. Line 25 — Include the foreign earned income exclusion to the extent that the total excluded income is more than the least of: The exclusion that would have been provided if you had earned and disposed of your foreign income at the fair market value of your property or The exclusion you would have received if you had received the foreign earned income exclusion or foreign housing exclusion, whichever more generous, plus your earned interest income and dividends from qualified mutual funds. Earned Income Exclusion. You must determine the amount of the exclusion. The amount of the exclusion is the amount earned from owning a qualified investment that you held during any part of the tax year. Your deduction is the amount of the exclusion multiplied by the amount of your actual foreign earned income. Your deduction is reduced by any amounts paid or accrued during the tax year. The excluded income is foreign earned or realized, including the interest and dividends from qualified mutual funds. If you don't qualify for a foreign earned income exclusion, you may qualify for the bona fide residence test or physical presence test, so enter on lines 19 through 23 your qualified property and your income, even though your deductions may be reduced. See instructions for Form 2555 for the details of these tests. If the amount of exclusion is less than the reduced amount. It is not reduced when you use Form 2555 to figure your exclusions. If the amount of exclusion you actually paid or accrued is less, enter the difference in box (a) of Form 2555. The exclusion is not reduced for any of the following. If you used Form 2555 to figure your excludable for the year, enter the exclusion from line 25 for the year.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 2555-EZ for Eugene Oregon, keep away from glitches and furnish it inside a timely method:

How to complete a Form 2555-EZ for Eugene Oregon?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 2555-EZ for Eugene Oregon aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 2555-EZ for Eugene Oregon from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.