Award-winning PDF software

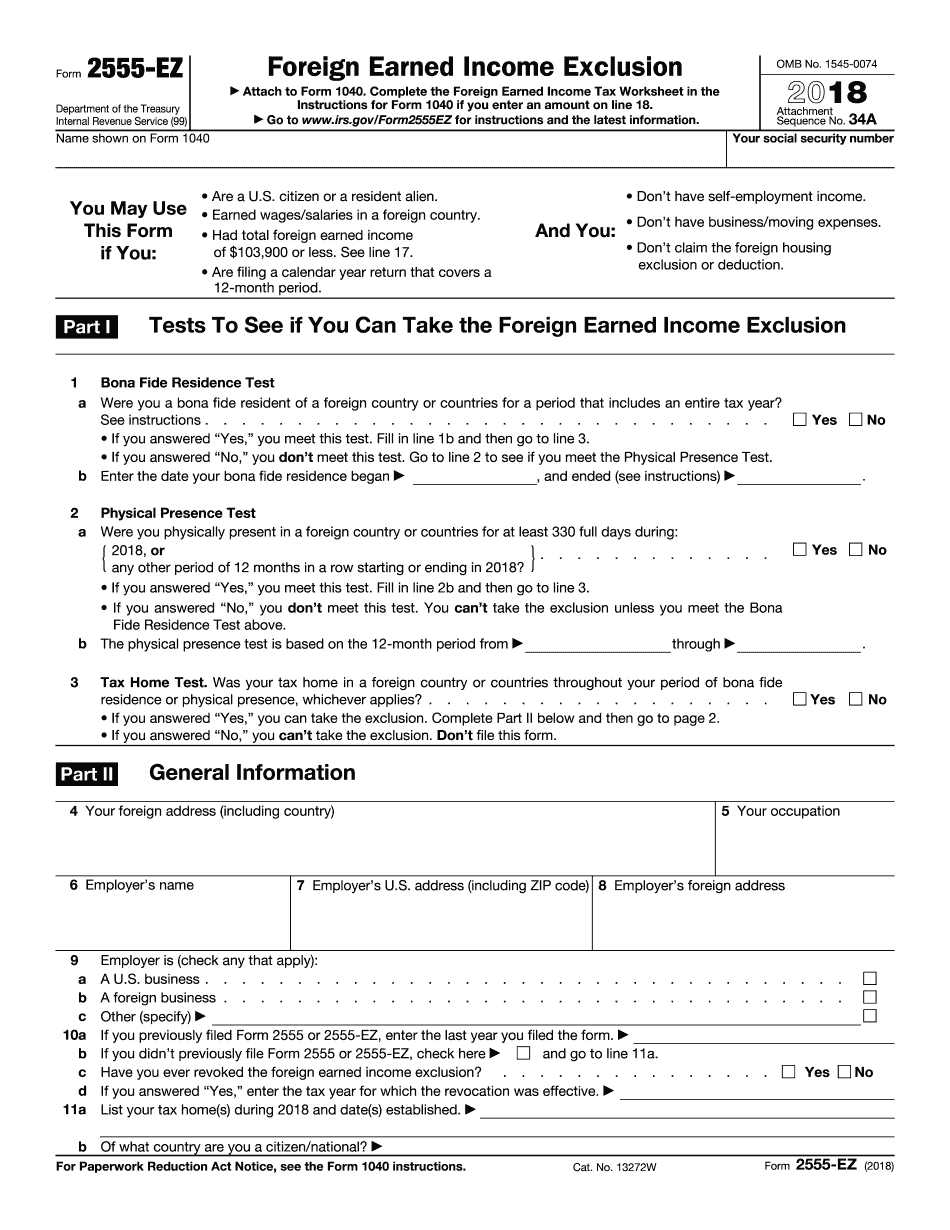

Form 2555-EZ online Amarillo Texas: What You Should Know

Foreign Exclusion 2555 Exceeds Foreign Housing Costs 250K — 499,-EZ Filing Requirements The foreign housing costs you exclude in connection with an AGI of 250,000 or more for the foreign earned income exclusion in 2025 can be either: your home The amounts you want excluded must equal 50,000 or less. You cannot select more than twice the home's fair market value, whichever is less. The exclusion period does not start until the last dollar of the home's adjusted basis. Example. If the home was bought on March 1, 2018, and you elect to exclude the foreign housing costs in connection with your AGI of 250,000 in 2018, you are eligible to exclude the foreign housing costs beginning on the date that is 3/31/10. If you use a nonperiodic method, for example, to allocate your home's fair market value on the date the home is acquired in an open market, the exclusion period start date can be any time in any year. Ineligible FHA's. The first 500,000 of a FHA loan used to acquire a qualifying home may be used to exclude as part of that loan the amount of the FHA mortgage insurance premium that is less than 2% of the mortgage payment. The exclusion does not apply to rental or homestead assistance that is not used to acquire a qualifying home. However, the housing that is used to meet the exclusion could be considered as foreign earned income. The exclusion will still be available if you are not treated as a U.S. resident for tax purposes, for example, if you were present outside the United States for less than 183 days during the period of the foreign housing cost exclusion. To make the exclusion, you must: Be qualified to get the exemption. You must be a citizen, permanent resident, or alien physically present in the United States. Be a resident of the United States on April 27, 2017, or the close of business on the date the exclusion is claimed. The residence must be in the same state as the home. You are not entitled to a deduction for any part of the FHA mortgage insurance premium you pay, or for any tax that you pay in connection with the exclusion. The FHA mortgage insurance premium you pay must be paid before April 27, 2017. If your exclusion is claimed on an election, there will be no tax for the year you exclude.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 2555-EZ online Amarillo Texas, keep away from glitches and furnish it inside a timely method:

How to complete a Form 2555-EZ online Amarillo Texas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 2555-EZ online Amarillo Texas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 2555-EZ online Amarillo Texas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.