Award-winning PDF software

Form 2555-EZ online Gainesville Florida: What You Should Know

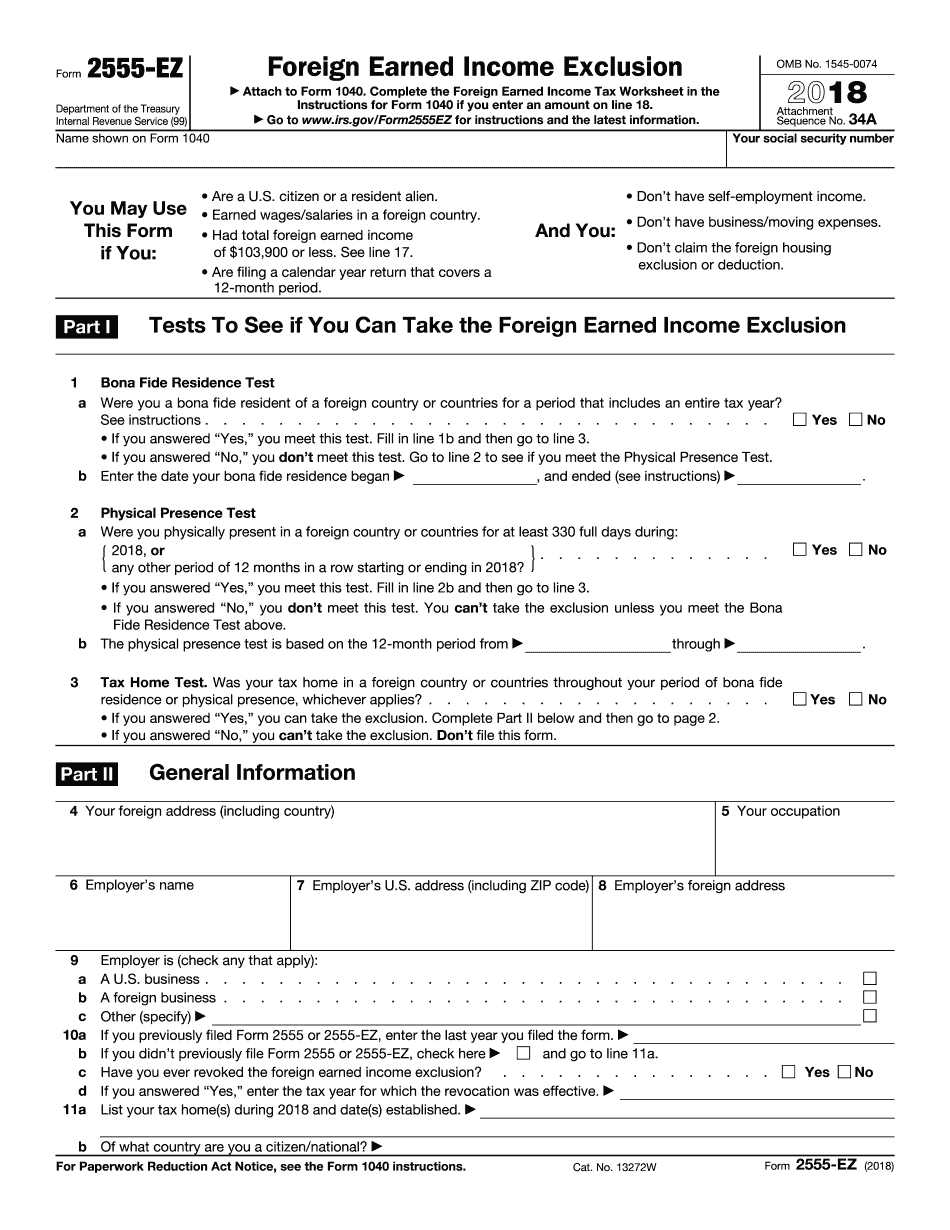

There are a few things to consider when filing. It pays to consult with a tax professional. Form 2555 is pretty straightforward, however. It just requires that you understand your situation, and have a working knowledge of the U.S. tax code. If you don't, you may want to hire a tax professional to review your situation and advise you. It is especially helpful if you plan to claim the foreign earned income exclusion by filing Form 2555-EZ. Form 2555, 2555-EZ, or 4563, or you are excluding income earned outside the United States with a special reason. . To qualify for the foreign earned income exclusion, you must be physically present in the United States at any time on the date the wages are earned, or the date you cease to be physically present in the United States on the date the wages are received. You also need to be present to take all necessary deductions. Qualified foreign persons. Qualified foreign persons include all citizens and resident aliens of the United States who have income earned in the United States and are not citizens or residents of certain countries, such as Mexico, Cuba, or Libya, and who intend to retain such income indefinitely. Foreign residents. If your income comes primarily from source in another country, you are considered a foreign resident of the country in which you lived (or intend to reside) on the date of the wages. You do not have to be physically present in the country on the date to receive the exclusion. For income, you will receive as a dividend, gain, or interest, there is essentially two methods to qualify. Dividend: The foreign income tax deduction is limited to an income tax equal to 30% of the amount of the income, although the minimum is higher depending on the country. As a dividend, income is reported on Form 1099-DIV at the rate of 28% or 30% of the payment. An additional adjustment can be made on Form 1099-INT. You can apply this method if the country your dividends are received from allows or requires withholding, in which case the rate of withholding is the same as the United States tax rate. A dividend is not considered taxable if it is paid more than 60 days before the end of the period for filing the return.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 2555-EZ online Gainesville Florida, keep away from glitches and furnish it inside a timely method:

How to complete a Form 2555-EZ online Gainesville Florida?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 2555-EZ online Gainesville Florida aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 2555-EZ online Gainesville Florida from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.