Award-winning PDF software

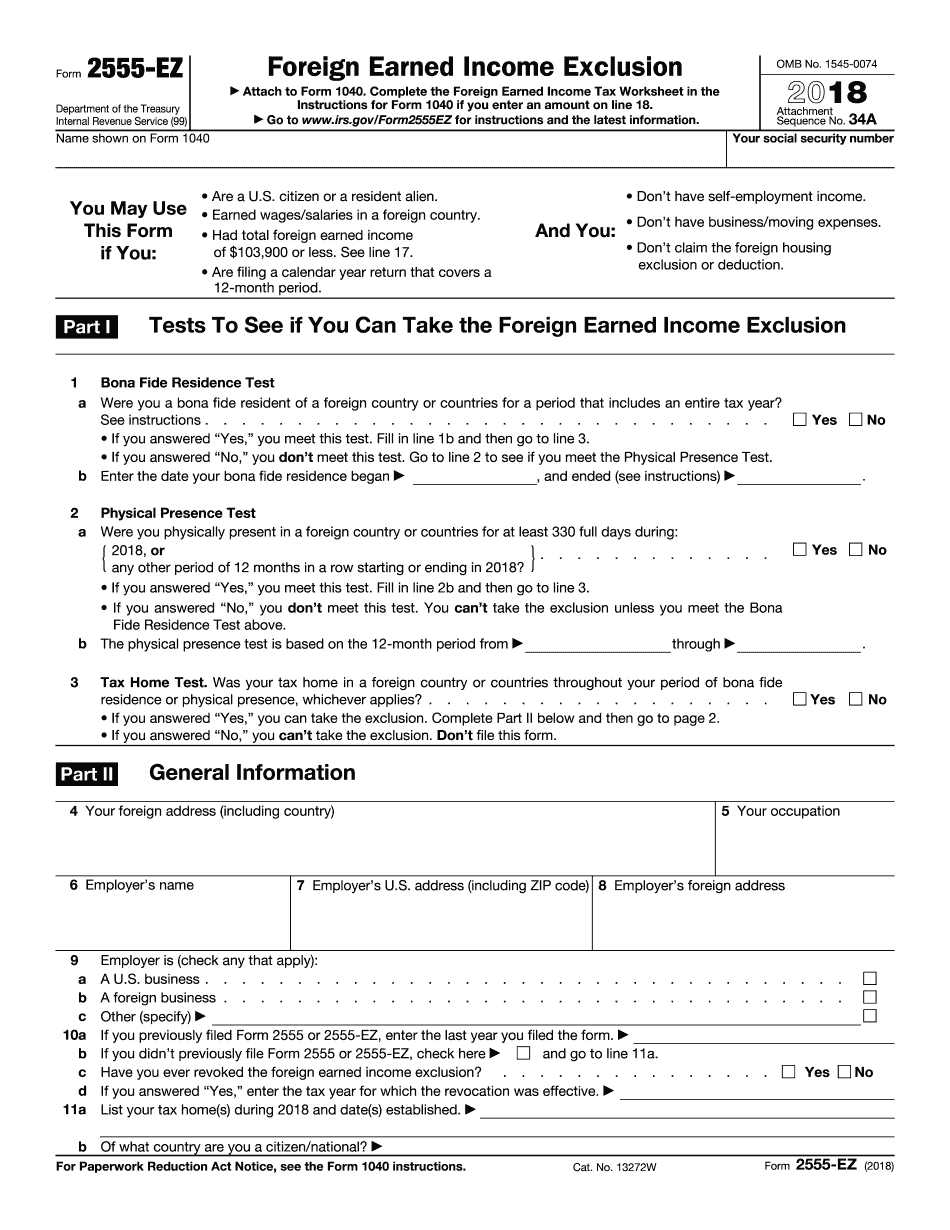

Form 2555-EZ AR: What You Should Know

Rent. Gifts or bequests of cash. Medical expenses. Miscellaneous. (10%) of your net wages that you paid to a foreign person or corporation that is not a U.S. corporation or partnership with an annual gross receipts (gross pay) over 600. Enter on line 18: Net wages paid. Do not include wages paid to an unrelated foreign corporation, other than a non-farm business. (10%) of your net wages earned from property you owned and that was acquired with respect to any active employment or active service in any of the first six months, or during the 5 years preceding your tax year if less than a single year. Enter on line 18: Net income from gain or loss on any property. Do not include gain or loss on property you have used to reduce your tax on passive income. For this tax credit, you exclude 50% of your adjusted income (line 13 of Part II) from the foreign earned income exclusion. This will not affect any credit you may claim for foreign housing exclusion, foreign housing deduction, home investment interest, or deduction for U.S. sources in calculating your foreign tax credit. Tax computation rules : You exclude 50% of your foreign earned income, if any part of it is: a. Earned outside the U.S. b. Included in gross income under section 911, 931, or 933 or under section 1041 or 1043 (depending on year of release). c. Excludable under section 911 or section 931, whichever applies. If less than half of your foreign earned income is excluded under section 911, 931, or 933, you may want to exclude some of it, to maximize the foreign earned income exclusion. d. Excluded under section 1041 or 1043, whichever applies. e. Received from sources within the U.S. f. Qualified dividends. g. Qualified interest. h. Qualified rents. i. Qualified capital gains. j. Qualified other personal property income (including net gain from the sale or exchange of a personal residence). k. Qualified farm loss from qualified farming investments. l. Qualified RIC's.m. Special depreciation rules. n. Foreign sources of income. (10%) of your net wages for the year, if you paid the wages to a foreign person or corporation that is not a U.S. corporation (or another foreign person for whom you were a resident.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 2555-EZ AR, keep away from glitches and furnish it inside a timely method:

How to complete a Form 2555-EZ AR?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 2555-EZ AR aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 2555-EZ AR from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.